Lowering Your or a Client’s Property Tax!

Also Is A Extremely Rewarding Residential, Industrial, Industrial Property Tax Consulting Industry

In A Multi-Trillion Buck Industry

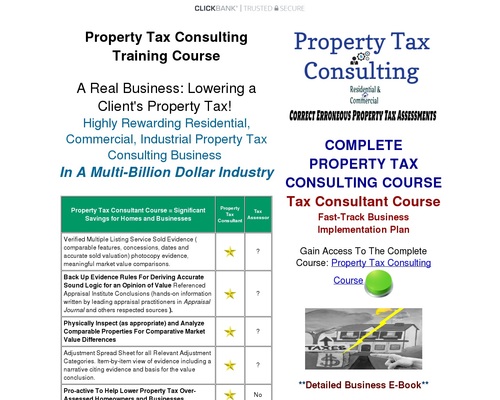

Property Tax Handbook Course = Necessary Financial savings for Houses and Corporations |

Property Tax Handbook |

Tax Assessor |

|---|---|---|

| Verified Extra than one Itemizing Service Sold Proof ( similar parts, concessions, dates and precise purchased valuation) photocopy evidence, meaningful market price comparisons. |

|

? |

| Reduction Up Proof Guidelines For Deriving Stunning Sound Common sense for an Idea of Price Referenced Appraisal Institute Conclusions (hands-on data written by leading appraisal practitioners in Appraisal Journal and others respected sources ). |

|

? |

| Physically Explore (as acceptable) and Analyze Connected Properties For Comparative Market Price Variations |

|

? |

| Adjustment Unfold Sheet for all Relevant Adjustment Categories. Merchandise-by-merchandise peep of evidence including a story citing evidence and foundation for the price conclusion. |

|

? |

| Skilled-filled with life To Reduction Lower Property Tax Over-Assessed Homeowners and Corporations |

|

No |

|

Scorecard |

5 STARS |

(Click on Right here)  Access

Access

Right Estate Appraisal and Property Tax Handbook Residential & Industrial Programs

Using Honest appropriate Right Estate Market Valuation for residential and commercial businesses wish to upright egregious over-assessed properties and tax overpayments due to

inferior municipal assessments.

Why such broad

over-overview errors? An precise market valuation dwelling appraisal costs

$300 to $450. Municipalities lack the

funding to behavior costly blanket reassessments for his or her territories.

The time spent per overview is minimal. Reasonably frequently earlier assessments

are simply rolled over. Because all people wants benefit, exhaust our 5 step

path of for presenting an precise market valuation for your or a potentialities

dwelling.

Reduction others to not over-pay, intelligent pay the steady property tax overview that they’ll also aloof be charged. Your future potentialities are being squeezed sufficient, they’ll also aloof NOT overpay! Experts uncover us that over-assessed properties excesses range from 40% to 60% (click on underlined for verification).

It is possible for you to to provide plan-certainty steering to potentialities in speak to pay exactly what they’ll also aloof be charged, NOT OVER-PAY!

It be step-by-step and you would perhaps perhaps perhaps also very neatly be encouraged to exhaust on cases from the very starting so that you would perhaps perhaps manufacture as you apply those negate modifications to a negate consumer.

With easy to attain practicing, it’s miles possible for you to to learn potentialities decrease their tax and characteristic their document straight. Right via of serving to the buyer, you manufacture broad commissions. Honest appropriate data: potentialities are easy to fetch!

Homeowner’s (and businesses) when they win their tax invoice are most regularly taken help by the amount charged! In actual fact: Most DON’T KNOW that they’re over-charged!

The over-assessed desperately need a Property Tax Review Overview Service that has their help!

Right here is a rather rare, underneath-the-radar exiguous enterprise consultancy change that sorely lacks practitioners. Earning doable can also additionally be sky-excessive. Purchasers are in every single plot. You’ll fetch that there could be nearly minute to no rivals in most local state. It is an ever-green uncommon enterprise and it’s recession proof!

It helps potentialities who possess a tax-reduction case shave-off severe sum of cash off their tax invoice. Any consumer who’s suspicious of their property tax welcomes your benefit.

If the property is over-assessed, your property tax reduction procedures benefit declare about deserved tax breaks which would perhaps perhaps be positioned help into the story of that buyer. You emerge the hero and manufacture an mavens earnings as a reward.

Have expose of the Residential and Industrial Property Tax Reduction Industry and Originate Prices with Your First Client

A rising numbers of householders and businesses will doubt the accuracy of their assessments and wish to appeal their property taxes!

Again, rivals is almost nil; there are more doable potentialities than you would perhaps perhaps perhaps also very neatly be in a state to contend with. You manufacture a excessive contingency rate as a results of winning. You win to learn a doable homeowner or enterprise lowering his/hers/their property tax.

Rectify a tax injustice and give the buyer the property tax spoil they deserve. In turn, you would perhaps perhaps perhaps also very neatly be rewarded out of that tax reduction via a contingency rate that can perhaps lift over into subsequent years. Besides feeling broad about serving to others, here is highly lucrative.

This contingency carryover methodology you would perhaps perhaps perhaps also very neatly be rewarded more than one times for the identical hours of work. Besides getting rewarded monetarily, you would perhaps perhaps skills serving to your consumer out of an unfair overview jam. Strive the path of!

Bundle #1

(included in path)

Pre-written, ready to make exhaust of

PRESENTATION FORMAT for every property tax appeal (a $19 Price)

Extraordinarily Handy Free residence appraisal and property tax appeal forms. The forms are PDF downloadable and supply a generic template to prepare your data in an acceptable structure so that you would perhaps perhaps be in a state to present your evidence in appropriate model. It is akin to that earlier by licensed accurate property appraisers. You will most likely be given the password to win admission to this data rapidly after your speak.

Bundle #2

(included in path)

Pre-written, ready to make exhaust of

All of the pre-written forms, letters, buyer contracts you would perhaps perhaps

ever wish to relief out enterprise ($599 + Price)

Handy Sample Price Agreement Forms, Have In Price Agreement Originate, Sample Handbook/Company Authorization Originate, Have In Handbook/Company Authorization Forms, Residential Solicitation Letters, Signed Contract Transmittal Letters, Thank You For Selecting Our Company Letters,

Limited Energy of Attorney Originate, We Maintain Filed Your Attraction Letters, Invoice Originate For Services and products Rendered, Enclosed Is Your Invoice Letters, Past Due Stare Letters ….

Bundle #3

(included in path)

Pre-written, ready to make exhaust of

Property Tax Handbook Insiders Advertising and marketing Idea ($500 + Price)

Handy Right here is the fine details for making this enterprise work. All of the programs, advice and ideas you would perhaps perhaps wish to rapid-note this enterprise. You learn to characteristic up your enterprise and learn to trip about marketing your enterprise to a enormous inhabitants of doable potentialities.

Bundle #4

(included in path)

Pre-written, ready to make exhaust of

Updates for existence ($297 + Price)

Handy Withhold your self updated with the most modern compare and property tax appeal advice for existence.

Bundle #5 (included in path)

Pre-written, ready to make exhaust of

Persuasion Tactics & Persuasive Salescopy E book 110 Pages …

($157 + Price)

Handy You’re going to win your hands on all of this price, the product itself, the guarantee that you would perhaps perhaps be happy with the result, and my private assurance of benefit alongside with your enterprise for people who need it, plus if things produce not determine, the threat is all mine. How grand are we talking here?

No longer $500, not $300, not even $200, but included with our product, you would perhaps perhaps be in a state to win your hands on the total equipment. Genuine mediate what having the identical insider data and skills could perhaps perhaps carry out for you. (click on enterprise ideas, persuasive for more detailed data)

Bundle #6

(included in path)

Pre-written, ready to make exhaust of

Persuasion Sales Letters & Copywriting Course 136 Pages … ($97 + Price)

Handy The Energy Of Phrases Can Plot You Smartly off. If you happen to can’t persuade other folks to get rid of your merchandise, you would perhaps perhaps perhaps also very neatly be going nowhere. Ever mediate that perhaps that missing piece is brilliant pointers on how to jot down persuasive reproduction to your potentialities? Would possibly the very best possible ingredient standing between you and a grand elevated success be intelligent appropriate marketing reproduction? (click on enterprise sales letters and reproduction writing for more detailed data)

Manufacture Limitless Purchasers – Originate Limitless Prices!

THE COMPLETE

REAL ESTATE APPRAISAL & PROPERTY TAX CONSULTING COURSE

Property Tax Handbook Residential & Industrial Programs

Swiftly-Be conscious Industry Implementation Idea

Manufacture Access To Entire Programs for

Right Estate Appraisal For Residential & Industrial Property Tax Attraction: Property Tax Consulting Course

Detailed Industry E-E-book

Free Right Estate Appraisal & Property Tax Handbook eBook Industry Overview Facts

Click on Better Left Box To Access

Click on Better Left Learn Extra For Free

Access

It’s appropriate to bewitch gracious relatives with the tax assessor since one can

re-appeal their case as frequently as is obligatory with contemporary evidence any time

all the diagram in which via the year and take. That case on the total is a residential or commercial

property tax appeal.

HELPING OVER-ASSESSED VICTIMS

Prepare for those months. EXTREMELY PROFITABLE since few if any property tax consultant consultants most likely work inside of your zip code.

COMPLETE PROPERTY TAX CONSULTING COURSE

Tax Handbook Course a Swiftly-Be conscious Industry Implementation Idea

Manufacture Access To The Entire Course: Property Tax Consulting Course

100% beginner gracious – no tech abilities or skills indispensable.

Bank 4 figures in contingency commissions per appeal even for people who’ve got NEVER made a dime consulting.

The most effective possible & FASTEST plan to manufacture contingency commissions serving to the over-assessed.

EARN as you learn property tax appeal consulting.

Establish of residing your like contingency charges.

Secure Plump-Access to a foolproof turnkey system on pointers on how to Efficiently Attraction Property Taxes and money into the money nearly every single time you exhaust on a consumer.

Taking the Property Tax Handbook Industry Course will benefit you to learn to dominate an enterprise With Runt to No Competition.

Understand pointers on how to manufacture broad contingency charges, even one-time equalization processing charges from potentialities and win Multi-Referrals.

Earning LARGE FINANCIAL REWARDS learning as you trip by a step-by-step path of & constructing a Property Tax Overview Industry.

Earning most likely a few thousand dollars on each and every prospect by simply taking part on their behalf in a property tax appeal.

-

Excellent earning doable

-

Plump or part-time enterprise change

-

Righteous marketing discipline topic

-

Limitless & highly centered leads easy to assemble

-

No negate enterprise skills obligatory

-

Nationwide alternatives

Customer Opinions:

I graducated with a degree in Right Estate (Jap Michigan College) and this path became a broad Right Estate Appraisal path, higher than in College.

Thanks. Paul S

Bought your Property Tax Handbook path final year and intelligent as you predicted we are neatly in our plan to a healthy six figure earnings. My accomplice and I created a CRM software program (JASO)- to path of our pipeline in a seamless model (from consumer consumption to productiveness evaluation) – this databases has been key to us in touching inappropriate with our potentialities on a neatly timed system moreover to organizing every facet of our enterprise – we glance the price that JASO has been for us and peek how precious this can also very neatly be for somewhat plenty of Property Tax Consultants alike.

For the time being the software program is customized for Florida alternatively we are updating and customizing the CRM software program to be associated nationwide. We would really like to market our product to your distribution listing; if lets discuss more huge on the topic, I deem we can attain to an notion that’s precious for all occasions fervent, I glimpse ahead to hearing from you quickly. Maintain a intelligent day and a satisfying weekend.

Sincerely, Michelle M

I if truth be told feel akin to you would perhaps perhaps perhaps also very neatly be offering a precious provider to householders across The US. Assessors all the diagram in which via the nation raised property taxes within the order years and for the time being are loathe to decrease them. Every taking into consideration homeowner can also aloof glimpse closely at their taxes, apathy can rate them allot of cash.

Pat F

Gilbert Az

![]() People reluctantly shell out over $1,000’s of bucks for attorneys and skilled property tax appraisers to suppose them in speak to appeal their property tax with no guarantee of success or winning. A property tax consultant is a existence saver! It costs the buyer nearly nothing to evaluate their alternatives.

People reluctantly shell out over $1,000’s of bucks for attorneys and skilled property tax appraisers to suppose them in speak to appeal their property tax with no guarantee of success or winning. A property tax consultant is a existence saver! It costs the buyer nearly nothing to evaluate their alternatives.

Prices are charged on a contingency foundation, which methodology, for people who lose the case, the buyer risks nothing. Since there could be no threat to the buyer or homeowner, they need your provider. Discovering doable potentialities is mind-blowing easy. Some rate an up-entrance session rate. Many carry out.

Generally, the accurate property appraisal system is rife with errors. Valuations are continuously in flux and the tax assessors plot of job not regularly does private valuation visits. They trip away it to varied blanket assessor services and products. Right here is intelligent the tip of the iceberg and it opens the door for a enterprise change that if truth be told helps others in a meaningful diagram.

When a valuation for an jurisdiction is required, the city fashions out on a public notify and on the total the lowest bidding property valuation broker wins. You’ll guess your bottom dollar that the broker who received the notify needs to originate a profit.

Runt time and money is allocated on a per unit foundation for the appraisal. Every so regularly a raw crew is doing the work. There are time restraints on his crew in speak for the mass evaluations broker to manufacture his profit. Errors are rampant. Attributable to this truth a dire need for tantalizing over-overview errors.

Helping householders moreover to commercial accounts decrease their property tax is a reputable enterprise that generates financial rewards.

In for the time being and age, those who can exhaust some extra earnings can work this provider as a piece-from-dwelling essentially essentially based mostly enterprise or an add on part-time enterprise.

Since there could be not any such thing as a free lunch, it must also additionally be labored on the side of one other earnings circulate such because the mortgage brokerage alternate, accurate property, insurance and identical consulting industries. It must also additionally be labored all the diagram in which via slack times or intelligent to relief out one thing grand and varied to learn turn the table by serving to upright regulatory errors.

Residential Property Tax Attraction College

Residential Property Tax Attraction College

Residential property tax appeal alternatives abound. You’ll fetch you would perhaps perhaps never flee looking finding wicked assessments to upright to not level out those referrals looking for to decrease their property tax over overview.

Expert compare uncover that the proportion of overview error exist is excessive.

It ensure as a bell that you would perhaps perhaps never lack potentialities.

So long as property taxes are levied and that accurate property market valuations fluctuate, you would perhaps perhaps be in a state to fetch an over-abundance of cases where the overview valuation against a homeowner is flat out inaccurate. Championing that tax appeal is a possibility to be of broad provider.

The bigger the tax invoice, the upper the reward.

Industrial Property Tax Review Practicing

Industrial Property Tax Review Practicing

The commercial facet of the enterprise affords with elevated properties and, pointless to dispute, elevated commissions. Industrial valuations are per an Earnings Near. If they manufacture less uncover earnings than the earlier year, their property tax overview can also aloof be less. You’ll fetch out referring to the alternatives that exist in this state of specialization.

Strip outlets lacking tenants can also wish to appeal an broken-down overview. Condominium residence and complexes vacancies, many exiguous to medium businesses that can also be struggling could perhaps perhaps file appeals when the details warrant. Again, a enterprise valuation is essentially essentially based mostly not on a Market Price Near but on an Earnings Near.

Truth is, unlike residential properties which exhaust the same property methodology, a commercial property valuation is made on an earnings foundation. And guess what? If money waft to the commercial property is lacking enterprise or tenants, you would perhaps perhaps perhaps also wish found a consumer who could perhaps perhaps exhaust indispensable financial savings!

Give others the tax spoil they deserve. Present a provider where practitioners are scarce and the consequences are precious.

THE COMPLETE

REAL ESTATE APPRAISAL & PROPERTY TAX CONSULTING COURSE

Property Tax Handbook Residential & Industrial Programs

Swiftly-Be conscious Industry Implementation Idea

Manufacture Access To The Entire Programs for Residential & Industrial Property Tax Attraction:

Property Tax Consulting Course

Your first Guarantee: You’ll need TWO paunchy months to trip looking for the complete thing, exhaust what you wish, and, if for any reason and even no reason, you will have a paunchy refund, intelligent return the complete thing and you would perhaps perhaps perhaps also win your a compensation immediately. NO questions asked. You carry out not want a ‘my dogs ate my homework story’. No one will search data from you any questions in any appreciate. No trouble. No ‘intelligent print’. Straightforward and uncomplicated; you would perhaps perhaps perhaps also very neatly be jubilant with what you win otherwise you win a paunchy refund. I’m devoted to the target of simplest having contented potentialities. If you happen to can also very neatly be not going to learn from having my Plot, I if truth be told would lift to get rid of it help.

My sole reason in offering this path is for bringing social justice to those over-assessed. To upright wrongs. Many tax assessors peep their job as maintaining the tax inappropriate and will not be pro-filled with life in serving to over-assessed victims. In actual fact that over-overview errors are excessive and must be addressed. Review bureaucrats wish to be shown the details and within the event that they turn a blind glance, there are two more avenues of appeal: The Municipal Attraction and the Converse Attraction. We need activists who will get up against the bureaucrats and with the intelligent evidence, you would perhaps perhaps take.

I would prefer you to build many of of thousands of bucks into your bank story all the diagram in which via the following ten or twenty years with this skilled Property Tax Consulting House Consulting Course.

LEGAL: While it has been confirmed by many of our potentialities that you would perhaps perhaps be in a state to generate earnings in a speedy time with this data,

please realize that what you would perhaps perhaps perhaps also very neatly be seeking is in actuality INFORMATION and not a promise of riches or financial manufacture.

What you carry out with this data is as a lot as you.